How Does MoneyPulse Work?

MoneyPulse financial wellbeing survey has been developed with the Melbourne Institute: Applied Economic & Social Research, the University of Melbourne, to bring you insights to support you in your financial life journey. Just like getting a health check-up, knowing where you sit on the financial wellbeing scale will provide you with insight and the resources to support you in improving your sense of financial wellbeing.

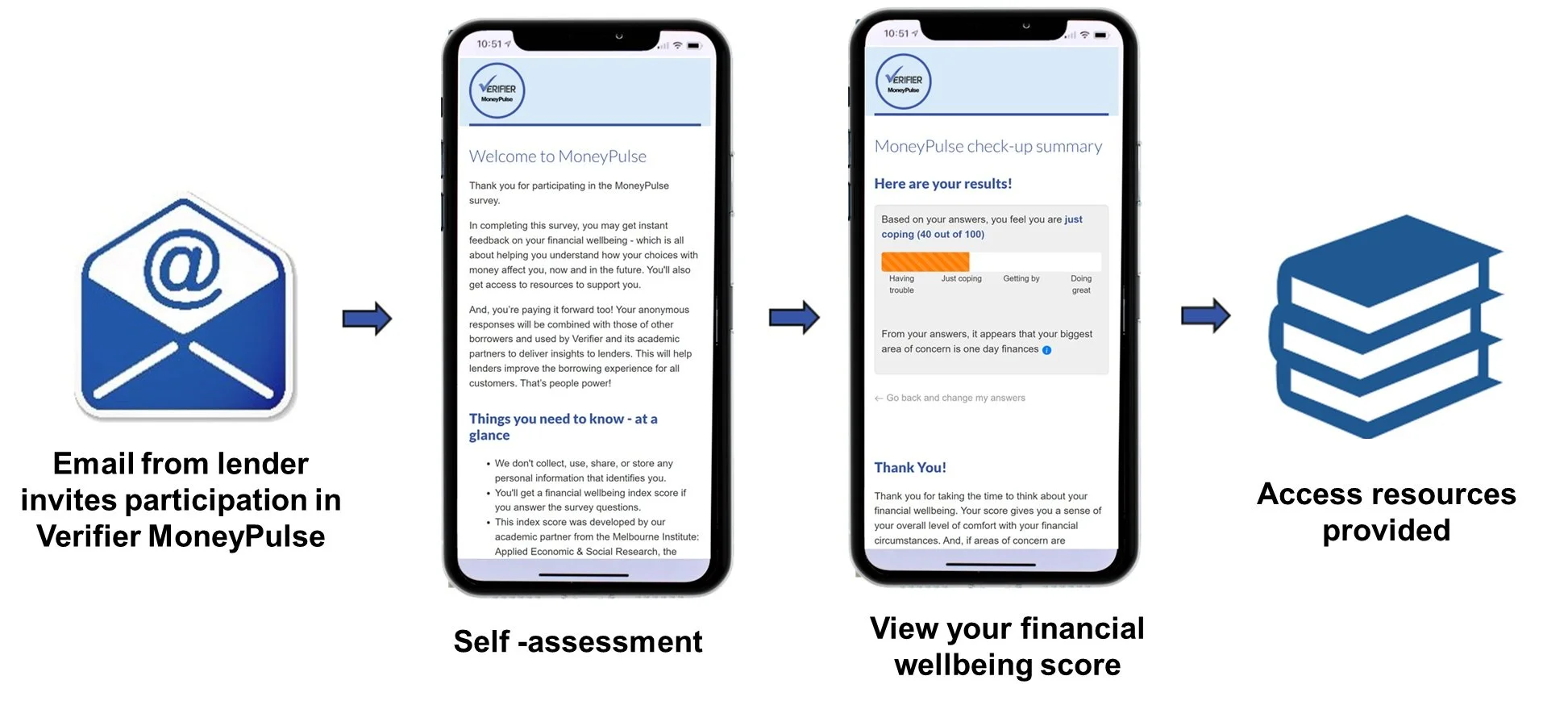

Your MoneyPulse journey begins with an email invitation from your lender, which will give you a link to Verifier and the MoneyPulse survey. When you are ready, click on the survey link in the email.

Instant feedback! Once you have submitted your responses, you’ll get a score that summarises your financial wellbeing. Your score is calculated based on the work of our academic partners from the Melbourne Institute.

Resources at your fingertips! You will get access to helpful resource suggestions, based on your score. These resources aim to provide you help if needed AND boost your financial literacy.

How We Handle Your Data - Important to Know!

At Verifier, we value your privacy as much as you do, and we adhere to the principles of privacy-by-design. You complete the MoneyPulse survey anonymously - no personally identifiable information is collected or shared.

Your lender introduced you to the survey, but Verifier and our academic partners never know who you are. Your result has a unique code which is what we use to do our work. And, your results are only displayed to you.

When we work and present findings and insights, we deal with groups of responses, not individual ones. For more see our Privacy Policy or contact us at moneypulse@verifier.me.