Powering your business with Financial Wellbeing

What is MoneyPulse?

MoneyPulse is an academically backed, 5 minute survey that calculates a customer’s Financial Wellbeing score, ranging from 0- 100. It also provides customers with a tailored suite of support and knowledge resources to help them on their journey. MoneyPulse is easily deployed and integrated into business processes such as application lodgement, customer onboarding, and ongoing check-ins. You can then use the aggregated insights to review outcomes by product and customer cohort.

If you can send outbound digital marketing, you can use MoneyPulse. It’s that simple.

“Latitude found MoneyPulse invaluable in understanding customer financial stress within the portfolio not highlighted by more overt measure such as missed payments. Response rates exceeded expectation, indicating customers saw value in completing the survey. MoneyPulse was easy to deploy whilst allowing Latitude to tailor customer communications. We are planning to repeat the survey to gain an up-to-date view given the changing environment.”

Tim Brinkler, GM Credit Risk, Latitude Financial Services

Customer and Product level financial wellbeing insights in one service

MoneyPulse is the RegTech service that delivers both insights to your customers and to your product governance team. The service you need to support the full range of customer outcome compliance requirements you have.

Verifier MoneyPulse can be used by any consumer facing services provider to boost customer literacy, increase engagement and meet your reputational and compliance obligations:

For super funds (Retirement Income Covenant)

For lenders (Responsible Lending and Design and Distribution Obligations)

For financial services providers (Design and Distribution Obligations)

For consumer facing providers beyond financial services – we support the S in ES&G

Moreover, we keep you ahead of regulation, by keeping your business focused on, and powered by, financial wellbeing.

Care for your customers…

Instant Feedback:

MoneyPulse offers instant feedback to your customers about their financial wellbeing via an academically backed score. Customers get their feedback online, anonymously, and with the opportunity to talk to you – their provider – if they want to.

Feedback covers Every Day, One Day and Rainy Day finances and can dive into analysis of their key financial habits if they wish.

All of which boosts financial literacy. And, in the case of superannuation, provides an academically backed, fully automated, toolkit to be part of your Retirement Income Strategy.

Tailored Insights:

Results screens can be configured with the optimal mix of resources, matched to your customer’s MoneyPulse scores, drawn from your collection of online assets AND from external sites such as moneysmart.gov.au.

Life Stage Relevant:

When key factors about the customer’s life experience matter, for instance in pre-retirement, MoneyPulse can ask the questions that enable you to adjust insights to that circumstance. And, if required, we can access data to support this process via the Consumer Data Right.

When does this matter? A classic example is pre-retirement, when factors such as what someone’s partner is doing, whether they have children and whether they own their home will have big impacts, in addition to their super balance (and investment mix).

MoneyPulse works at five levels to meet and exceed community expectations:

Diagnose: The instant feedback scores provide rapid diagnosis of financial wellbeing

Educate: Provide access to resources to support consumers.

Help: Assist consumers to self-diagnose anonymously, and make sure that they know they can reach out for help if needed and make that process easier. And, if they want to talk, the MoneyPulse scores can then power those conversations.

Empower: Allow consumers to make smarter choices every day.

Support: Encourage good financial habits and promote financial literacy.

...and automate product level insights

MoneyPulse enables you to monitor customer financial wellbeing outcomes at the portfolio and product level, in addition to product outcomes and customer satisfaction outcomes you already track. These powerful insights can support the evolution of your origination’s product, distribution and customer communication strategies, helping you to meet obligations in regard to Responsible Lending, Design and Distribution and Retirement Income Strategy. Depending on your product profile.

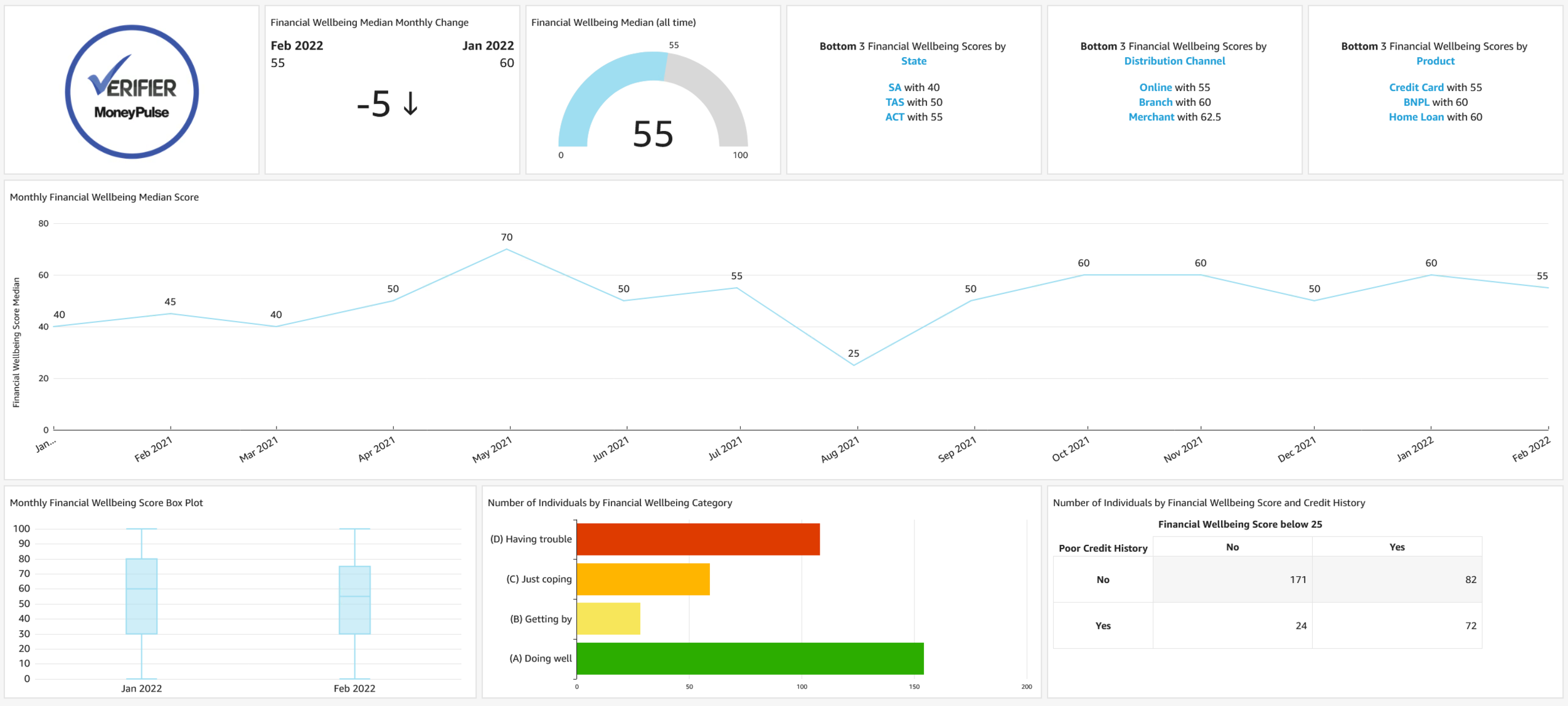

The results of your individual customers responding are de-identified, joined with product journey data that you extract and share with us, aggregated and presented to you continuously via the MoneyPulse Dashboard.

Your product, risk and governance teams can now monitor your portfolio from the perspective of actual customer outcomes.

Academic Foundations (and ongoing input)

Verifier has partnered with the Melbourne Institute: Applied Economic & Social Research, the University of Melbourne, to create a financial wellbeing index score tailored to financial products. Verifier is working with the Melbourne Institute on an ongoing basis to ensure the survey methodology is robust, and to continuously evaluate and fine tune it.

Industry Policy: At the industry level if you choose to opt-in, Verifier aggregates data across providers and works to produce policy papers and research papers to support better policy settings. The MoneyPulse service provides an evidence base to support better policy and regulation.

Consumer outcomes should be powering your business, not just product outcomes: MoneyPulse provides both consumers and their providers with financial wellbeing insights to support better outcomes. For everyone.

To find out more click on the button below and request a demo.